Will Higher Education Learn from Lessons of Mount Ida College?

When its trustees abruptly shut down Mount Ida College, a small, private college just outside Boston, they unleashed a debacle that resulted in a torrent of criticism and considerable finger pointing. Rejecting a merger or acquisition (depending on the characterization) with Lasell College, the trustees opted to sell the campus to the University of Massachusetts at Amherst, whose leadership saw the location in the middle of Boston’s high technology belt as an opportunity. UMass Amherst also assumed all of Mount Ida’s debt.

According to UMass Amherst officials, the acquisition permitted them to find a location that would assist their students who held internships with Boston area companies, among other benefits. Mount Ida’s students (and their parents) were caught off guard and speculated openly and angrily about where and even how to continue their education. Transferring to the UMass Dartmouth campus – about 50 miles away – made little sense to students who chose the bucolic, suburban Mount Ida campus for its fit, programs, and location. At their last Commencement, students successfully banned the trustees and president from attending the ceremony.

UMass System Criticized for Favoring Flagship Over Other Campuses

The backlash increased as UMass Boston weighed in on the closure. Many at the Boston campus saw the acquisition as an infringement by UMass Amherst on their territory. More significantly, they faulted the UMass system for failing to advocate more directly for the UMass Boston campus as aggressively as for the Amherst flagship.

Local newspaper columnists openly criticized the UMass administration for a lack of transparency and for failing to listen to UMass Boston faculty and staff on this and a wide range of other issues, including the collapse of a recent search for a chancellor for the Boston campus.

State Inquiry May Result in Greater Regulation of Private Colleges

As the navel gazing begins, Massachusetts Attorney General Maura Healey has opened an inquiry into Mount Ida’s closure, suggesting that additional regulations may be needed on private higher education to prevent these kinds of messes from occurring again.

Richard Doherty, president of the Association of Independent Colleges and Universities of Massachusetts (AICUM), has argued that Mount Ida’s failures were specific to that institution and should not be extrapolated to produce more regulation for the other private colleges and universities in the state.

What a mess – on several levels.

Let’s set aside the finger pointing and the effort to condense a slew of bubbling frustrations and emotions into a crisis that shapes bad public policy. Is there anything that can be done to right the ship?

Core Issue is a Failure of Trustee Leadership

There is, beginning with the understanding that Mr. Doherty is correct when he argues that Mount Ida is one incident and not a more damaging trend. The failure at the core of the controversy seems most clearly to be a failure by Mount Ida’s trustees to lead.

Mount Ida’s trustees did not exercise appropriate, conservative fiscal oversight of the institution. Further, they permitted the college’s financial mishaps to drive the timing and the transparency that led to the closing and resulted in the public implosion and outcry.

College’s Closure Also Points to Accreditation Failure

Second, the accrediting agencies should have known more about the condition of the institution.

When accreditation works well, it’s always a better alternative to state and federal oversight.

The fact is that we need better predictive, analytical tools by which to measure financial health across peers – even if only confidentially for internal institutional use – to determine in consort with accrediting agencies the true financial picture. Knowing earlier will better prevent future debacles like Mount Ida.

New Approaches Needed to Prevent Closures of More Colleges

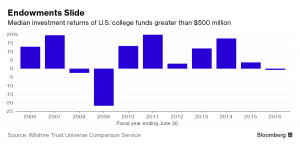

Third, we need new products and approaches to assist colleges to help ease the inevitable. It is likely that colleges and universities will be forced to cooperate more to improve efficiency and create economies of scale. This is especially likely among small- and mid-sized private colleges and universities.

It is apparent that there will be an uptick in mergers, acquisitions, and occasionally, closures across America. Higher education needs an orderly process and a clear pathway to cause minimum disruption for students.

State governments can help by working to develop new programs like catastrophic insurance that will address how to handle closures, including the disposition of assets, laid off employees searching for work, and displaced students seeking to complete their degrees.

This is especially true if colleges have a reasonable financial stress test against which to measure the need for additional insurance.

Fourth, when public universities play a role, we need a better understanding of regulatory authority. For issues that cross campus lines within a system, the central administrative offices must have more authority to say yes – and no – over how debt shapes opportunities and challenges across the system.

Beware of One-Size-Fits-All Regulations for Colleges & Universities

Finally, beware of state regulators applying a uniform standard developed from a self-inflicted crisis. Government operates on an annual appropriations cycle in most places. Elections further shape how long-term strategy – if any – gets made.

The right kind of regulatory assistance – like catastrophic insurance – makes sense to explore. Intruding deeper into the management of colleges and universities – especially private ones – is unnecessarily bureaucratic.

Let’s hope that we learn the lessons of Mount Ida. It would be a shame to see a sad moment become a harbinger of worse things to come.